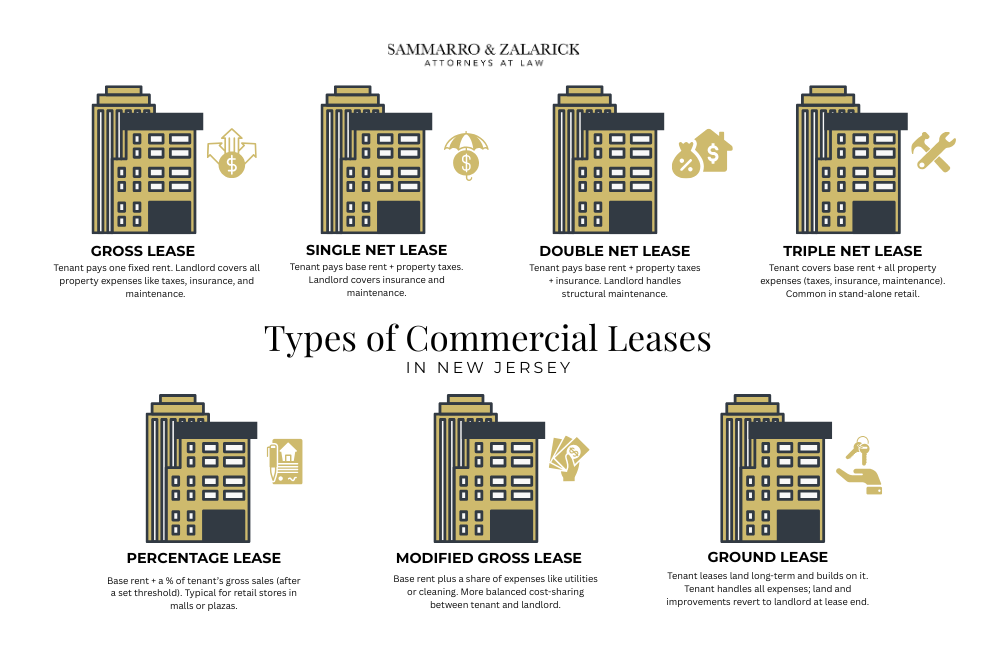

While there’s nothing especially unique about commercial leases in New Jersey when it comes to the types of leases used, it’s still essential to understand what lease structure you’re dealing with. Whether you’re leasing office space, a retail storefront, or industrial property, each lease type comes with its own responsibilities, risks, and financial implications. Knowing the differences can help you avoid surprises—and negotiate smarter.

Gross Lease (Full-Service Lease)

The tenant pays a fixed rent each month. The landlord covers all operational costs for the property, including property taxes, insurance, maintenance, and sometimes utilities.

Pros: Predictable monthly costs for tenants.

Cons: Landlords may charge a higher base rent to offset their responsibility for variable costs.

Best For: Small businesses or short-term tenants who want simplicity.

Net Lease

A net lease requires the tenant to pay base rent plus some or all property expenses. There are three common types:

Pros: Often lower base rent; clarity in financial obligations.

Cons: Potential for high and unpredictable costs; tenant bears more risk.

Best For: Larger tenants or long-term leases, where tenants can manage property-related expenses more efficiently.

Modified Gross Lease

A modified gross lease blends aspects of both gross and net leases. Typically:

Pros: More flexibility than a net lease; shared cost structure.

Cons: Can become complex when reconciling shared costs.

Best For: Multi-tenant buildings; mid-sized companies.

Percentage Lease

Under a percentage lease, the tenant pays base rent plus a percentage of gross sales, typically after reaching a sales threshold.

Pros: Lower base rent; aligns landlord interest with tenant success.

Cons: Complex accounting and disclosure of sales figures.

Best For: Retailers in high-foot-traffic locations.

Ground Lease

A ground lease involves leasing the land only, allowing the tenant to develop and operate on it. Typically long-term (30–99 years).

Pros: Tenant can build to suit; long-term investment.

Cons: Land reverts to landlord at lease end, including improvements unless otherwise agreed.

Best For: Franchisees, developers, and companies building long-term assets.

Legal Considerations in New Jersey:

Choosing the right commercial lease is about more than just the rent—it’s about aligning risk, control, and financial planning with your business goals. Review every lease with legal counsel before signing, and make sure you fully understand your obligations and protections under New Jersey law.

In New Jersey, the Triple Net Lease (NNN) is among the most commonly utilized commercial lease structures. This lease type is prevalent across various commercial properties, including retail spaces, office buildings, and industrial facilities.

Triple Net Lease (NNN):

Under a Triple Net Lease, tenants are responsible for paying the base rent plus all additional property expenses, which typically include:

• Property Taxes

• Insurance Premiums

• Maintenance and Repairs