Property taxes are a significant expense for homeowners, and in a state like New Jersey, where property taxes are among the highest in the nation, they can be a source of financial stress. However, relief is available through various property tax relief programs designed to alleviate the burden and make homeownership more manageable. Whether you’re a first-time homeowner, a senior on a fixed income, or someone facing financial hardship, understanding how these programs work can help you save money and secure your financial future. This comprehensive guide covers the most prominent property tax relief programs in New Jersey, eligibility requirements, application processes, and tips for maximizing your benefits.

Why Property Tax Relief Programs Matter

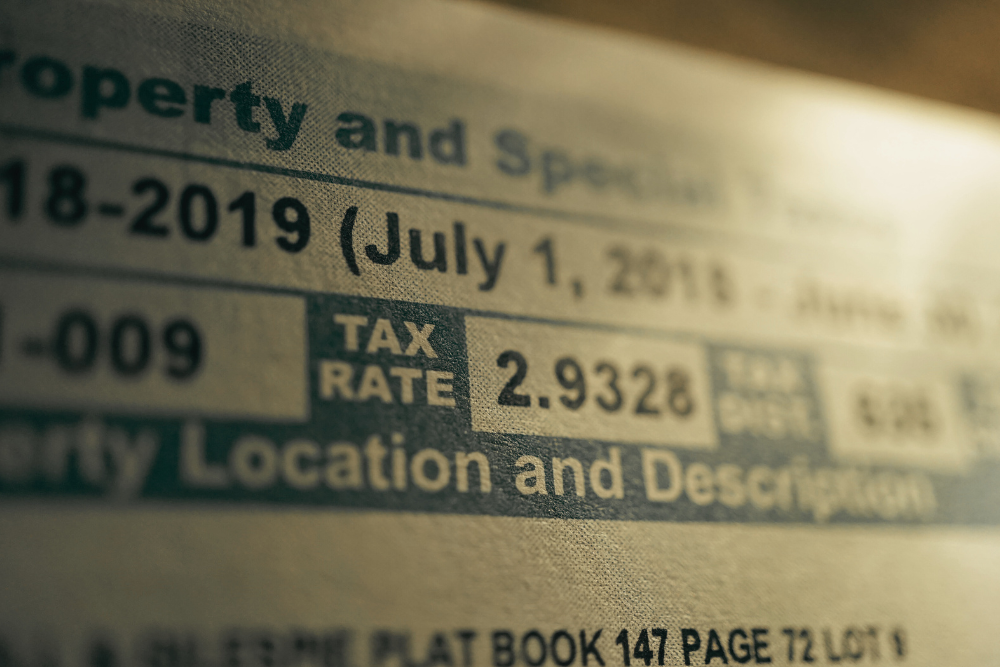

New Jersey’s property taxes are some of the highest in the United States, averaging more than $9,000 annually per household. These taxes fund essential services like public education, emergency services, and infrastructure, but they can strain household budgets.

Property tax relief programs are more than just financial assistance—they are essential tools that provide stability, security, and equity for homeowners across New Jersey. By understanding the broader impact of these programs, it becomes clear how they benefit individuals, families, and communities alike. Below, we expand on the three core benefits:

Key Benefits of Property Tax Relief Programs:

Financial Relief: Reduce Your Annual Tax Bill

For many homeowners, property taxes are one of the largest recurring expenses, often rivaling mortgage payments. Relief programs can significantly reduce these costs, freeing up much-needed funds for other essential expenses like healthcare, education, and home maintenance.

Expanded Benefits Budget Flexibility

Budget Flexibility

A reduced property tax burden allows homeowners to better allocate their income toward savings, investments, or other financial priorities.

Emergency Preparedness

With more disposable income, families can build emergency funds, reducing the risk of financial instability during unexpected events such as job loss or medical emergencies.

Support for Long-Term Goals

For families saving for their children’s college education or planning for retirement, tax relief programs provide critical breathing room to achieve these milestones.

Example:

A senior citizen enrolled in the Senior Freeze Program might save hundreds—or even thousands—of dollars annually by eliminating property tax increases. This reduction could cover the cost of prescriptions, home repairs, or other important expenses.

Home Retention: Avoid Foreclosure or Forced Sales

Rising property taxes can push homeowners, particularly those on fixed incomes, to the brink of foreclosure or force them to sell their homes. Tax relief programs help prevent this by making homeownership more affordable and sustainable.

Expanded Benefits

Overview of Property Tax Relief Programs in New Jersey

New Jersey offers several property tax relief programs for residents. While each program has unique eligibility criteria, they generally aim to assist homeowners who are struggling to manage their tax obligations. Below is a breakdown of the major programs available:

1. Senior Freeze Program (Property Tax Reimbursement Program)

The Senior Freeze Program is designed to help senior citizens and disabled residents by reimbursing them for property tax increases. The program effectively “freezes” property taxes at a base year amount, meaning eligible homeowners won’t have to worry about increases over time.

Eligibility Requirements:

• Must be 65 years or older (or disabled as defined by Social Security).

• Must have lived in New Jersey for at least 10 years.

• Owned and lived in the same home for at least three years.

• Total annual income must fall below the set threshold (for 2023: $99,735).

Application Process:

• Submit a Senior Freeze Application (Form PTR-1) by the annual deadline.

• Provide proof of income and property tax payments.

Benefits:

• The state reimburses you for any property tax increases that occurred after your base year.

2. Homestead Benefit Program

The Homestead Benefit Program provides direct property tax relief to eligible homeowners. This program benefits individuals by reducing their property tax liability based on income and other qualifying factors.

Eligibility Requirements:

• Must be a homeowner in New Jersey as of October 1 of the qualifying year.

• Must meet income limits:

• Senior citizens and disabled homeowners: Up to $150,000 annually.

• All other homeowners: Up to $75,000 annually.

• Property must be your primary residence.

Application Process:

• File an application online or by phone, typically during the application period announced by the state.

Benefits:

• The benefit is applied directly as a credit to your property tax bill, reducing the amount owed.

3. Veterans Property Tax Deduction

New Jersey honors veterans by offering a $250 annual deduction on property taxes. This deduction helps ease the financial burden for those who have served in the armed forces.

Eligibility Requirements:

• Must be a veteran honorably discharged from active duty.

• The property must be your primary residence.

• Surviving spouses of eligible veterans may also qualify.

Application Process:

• File a Veterans Deduction Application (Form V.S.S.) with your local tax assessor.

Benefits:

• A direct $250 deduction applied to your annual property tax bill.

4. Property Tax Exemption for Disabled Veterans

Disabled veterans in New Jersey may qualify for a full exemption from property taxes, significantly reducing their financial burden.

Eligibility Requirements:

• Must have a permanent and total service-connected disability certified by the Department of Veterans Affairs.

• The property must be the veteran’s primary residence.

• Surviving spouses may also qualify.

Application Process:

• Submit the Disabled Veterans Property Tax Exemption Application (Form D.V.S.E.) to your local tax assessor.

Benefits:

• Complete elimination of property taxes on the qualifying residence.

5. NJ Anchor Program

The Anchor Program (Affordable New Jersey Communities for Homeowners and Renters) is a newer initiative designed to replace the Homestead Benefit Program. It provides property tax relief to both homeowners and renters.

Eligibility Requirements:

• Homeowners:

• Must have owned and occupied a home as of October 1 of the qualifying year.

• Income limits: Up to $150,000 for maximum benefits.

• Renters:

• Must have rented and occupied a residence as of October 1 of the qualifying year.

• Income limits: Up to $150,000 for maximum benefits.

Application Process:

• Applications are typically submitted online or by mail.

Benefits:

• Homeowners receive credits or direct payments to reduce property tax bills.

• Renters may qualify for rebates to offset rent costs.

How to Apply for Property Tax Relief Programs in NJ

Step 1: Determine Eligibility

Review the criteria for each program to identify the ones you qualify for. Pay special attention to income limits, residency requirements, and deadlines.

Step 2: Gather Documentation

Most programs require proof of:

• Property ownership or residency.

• Income (e.g., tax returns, W-2s).

• Property tax payments or rental agreements.

Step 3: Submit Applications

Applications can typically be submitted online, by mail, or in person. Ensure you meet the deadlines for each program to avoid missing out on benefits.

Step 4: Monitor Your Status

Keep track of your application status and respond promptly to any requests for additional information.

Common Mistakes to Avoid

1. Missing Deadlines: Many programs have strict deadlines, so mark your calendar and apply early.

2. Failing to Update Information: Ensure your contact and income details are accurate to avoid processing delays.

3. Overlooking Eligibility: If you’ve recently retired, become disabled, or changed your financial situation, re-check eligibility for new programs.

4. Not Seeking Help: If the application process seems overwhelming, consult a professional for assistance.

Tips to Maximize Property Tax Relief

• Combine Benefits: If eligible, you can often apply for multiple programs (e.g., Homestead Benefit and Veterans Deduction).

• Stay Informed: Monitor updates to income thresholds and program details annually.

• Appeal Property Tax Assessments: If you believe your property taxes are too high, consider filing an appeal to have your assessment reviewed.

How Sammarro & Zalarick PA Can Help

At Sammarro & Zalarick PA, we specialize in helping New Jersey homeowners navigate the complexities of property tax relief programs. Our experienced attorneys provide personalized advice to ensure you maximize your benefits and reduce your financial burden.

Our Services:

• Eligibility Analysis: Determine which programs you qualify for and ensure compliance with all requirements.

• Application Assistance: We guide you through the paperwork and submission process.

• Tax Appeals: If your property taxes are based on an unfair assessment, we can help you challenge it.

• Estate Planning: For seniors and veterans, we offer comprehensive estate planning to ensure long-term tax savings.

Why Choose Us?

With years of experience in New Jersey’s legal landscape, we are dedicated to providing trusted, results-driven representation. We understand the challenges homeowners face and are committed to helping you achieve financial peace of mind.

Conclusion

Property tax relief programs in New Jersey provide vital support for homeowners facing the state’s high property taxes. From the Senior Freeze Program to the Anchor Program, these initiatives can help reduce your annual tax bill, protect your home, and improve your financial stability.

If you’re unsure where to begin or want to ensure you’re taking full advantage of available benefits, contact your trusted NJ attorneys today. Our team is here to simplify the process and help you make the most of New Jersey’s property tax relief programs. Schedule your consultation now and take the first step toward lasting financial relief.